The Crosstab Weekly Newsletter 📊 January 20, 2019

Americans want the rich to pay more taxes. Lefty Democrats are jumping on the opportunity.

Welcome! I’m G. Elliott Morris, data journalist for The Economistand blogger of polls, elections, and political science. Happy Sunday! Here’s my weekly newsletter with links to what I’ve been reading and writing that puts the news in context with public opinion polls, political science, other data (some “big,” some small) and looks briefly at the week ahead. Let’s jump right in! Feedback? Drop me a line or just respond to this email.

This newsletter is made possible by supporters on Patreon. A special thanks to those who pledge the top two tiers is written in the endnotes. If you enjoy my personal newsletter and want it to continue, consider supporting it on Patreon for just $2.

This Week's Big Question

Do Americans want to tax the rich more? Unequivocally: yes.

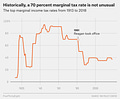

The predominant feeling among Americans, plain and simple, is that the rich don’t pay their fair share in taxes. Politicians like Alexandria Ocasio-Cortez have recently called for the top-marginal tax rate to rise to as much as 70% for those making more than $10m per year (for more on what this means, read my blog post). Historically, that would not be an unusual tax rate. In the Democratic-dominated eras of the New Deal and great society, the top marginal rate floated between 70 and 90 percent:

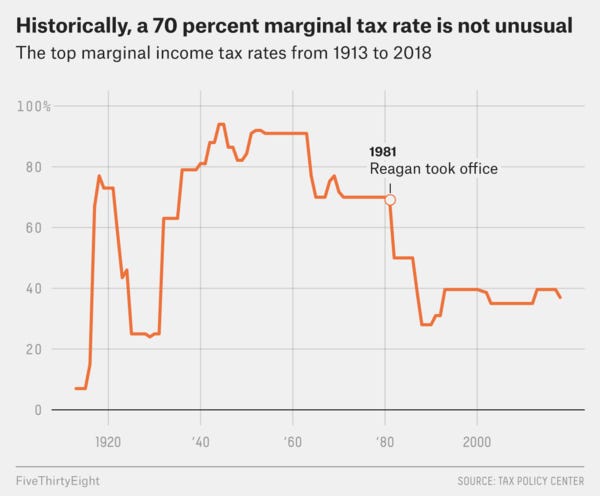

Many have objected to this idea, claiming that taxing the wealthy would hurt economic growth by impairing corporations’ ability to pay workers more money, or making other such arguments. Putting those aside, some commentators don’t even seem to understand what marginal tax rates are at all. And while it is certainly true that upper-middle class and rich Americans would face a larger tax burden if the government shifted the distribution of the tax brackets up and skewed higher for the wealthy, the differences aren’t nearly as large as you’d expect — and, I’ll note, higher rates at lower brackets is not guaranteed, it has just been the historical standard. Here, I’ve visualized what different rates looked like in 1970 vs 2018 (before any tax credits or deductions are applied):

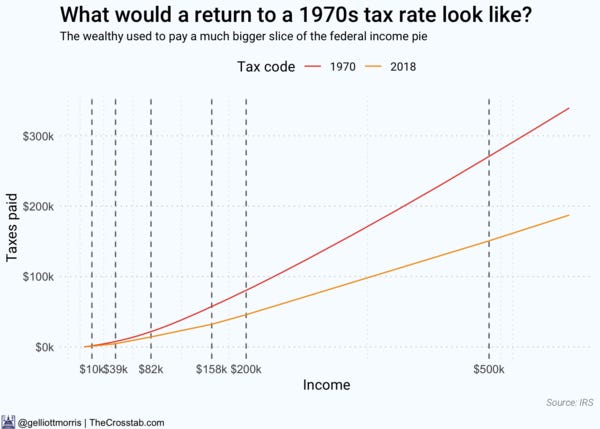

And you can see that the biggest delta between 2018 and 1970 happens for the super-wealthy (who still don’t quite end up paying 70% of their total income in taxes):

So, that’s what we’re looking at. How do Americans feel about such a proposal? Well, in two words, they support it. Further, they have for quite a while.

According to a poll from The Hill and Harris X out last week, 59% of registered voters support the idea of raising the top marginal tax rate to 70%, including about 45 percent of Republicans. Notably, this contrasts with 29% of voters who approve of the tax cuts passed by Donald Trump and Congressional Republicans in 2017, according to YouGov’s polling done on behalf of The Economist.

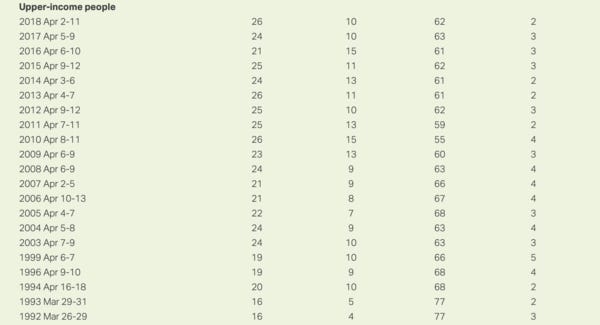

Notably, this support for high tax rates on the wealthy is not new. Gallup has found that at least a majority of Americans support higher tax rates on “upper-income people” since at least 1992:

Additionally, since at least 1984, about 60% of Americans polled by Gallup agreed that “the money and wealth in this country should be more evenly distributed among a larger percentage of the people.” “The rich don’t pay their fair share,” the average American says, “and in recent memory, they never have,” one of those voters might say.

As we head into the full-throated 2020 campaign, it’ll be interesting how different Democratic nominees take positions on this issue. We already know that it’s going to be a focal point on the left: for example, read my take on Elizabeth Warren’s candidacy. Perhaps even before then, Congress will talk more seriously about enacting a more redistributive tax plan (though one certainly won’t come about when America is ruled by divided government).

Political Data

New allegations against Donald Trump raise the odds of impeachment

DURING THE campaign for America’s mid-term elections last year, Republican candidates warned that Democrats would try to impeach Donald Trump if they won control of the House of Representatives.

Zip code better predictor of health than genetic code

‘Education and health also follow the “Delmar Divide,” with residents to the north less likely to have a bachelor’s degree and more likely to have heart disease or cancer.’

Managers in football matter much less than most fans think

Upgrade your inbox and get our Daily Dispatch and Editor’s Picks. “I THINK I am a special one,” José Mourinho boasted in 2004. One of football’s most lauded managers, he won six domestic titles in his first 11 seasons in top leagues. But his powers have deserted him of late.

The activists decide: the preferences of party activists in the 2016 presidential nominations

‘Some activists in each party resist the signals from elites, but the resistance is far less widespread in the Democratic Party, where party leaders exhibited consensus support for the eventual nominee.’

Generation Z Looks a Lot Like Millennials on Key Social and Political Issues

No longer the new kids on the block, Millennials have moved firmly into their 20s and 30s, and a new generation is coming into focus.

www.pewsocialtrends.org • Share

Polling Shows Ocasio-Cortez’s Rising Fame

She’s also making a name for herself beyond the Beltway. The latest Morning Consult/Politico survey found Ocasio-Cortez to be better known than a number of the Democratic Party’s possible 2020 presidential contenders, including former Texas Rep.

The migrant surge on America’s border slowed long ago

AMERICA’S GOVERNMENT has now been shut down for nearly a month over Donald Trump’s signature campaign promise to build a wall along the United States-Mexico border. Mr Trump says a wall is needed in order to stop people pouring into the country illegally.

How 17 Long-Shot Presidential Contenders Could Build A Winning Coalition

It might seem obvious that having a wide-open field, as Democrats have for their 2020 presidential nomination, would make it easier for a relatively obscure candidate to surge to the top of the polls. But I’m not actually sure that’s true.

Other Data and Cool Work

Facebook Algorithms and Personal Data

Most commercial sites, from social media platforms to news outlets to online retailers, collect a wide variety of data about their users’ behaviors.

Political Science and Survey Research

Do countries that have more immigrants have more terrorist attacks? Nope. Do countries that have more immigrants from Muslim Majority Middle Eastern and North African (MENA) countries have more terrorist attacks? Still nope.#SocSciResearch https://t.co/iEIqAmrBge https://t.co/tUMBvMqqfo

10:26 AM - 16 Jan 2019

What I'm Reading and Working On

Last week, I wrote about the counterproductive economic effects of tariffs and trade protectionism and about the shifting odds of Trump’s impeachment after BuzzFeed’s (now-disputed) claims that Trump directed Michael Cohen to commit perjury. This week, I’m in Austin Texas to write about evangelical voters and present some post-2018 and pre-2020 data at the Southern Political Science Association (for which materials can be found on GitHub).

Thanks!

Thanks for reading. I’ll be back in your inbox next Sunday. In the meantime, follow me online or reach out via email. I’d love to hear from you!

A Special Thank-you Note to Patrons

My weekly newsletter is supported by generous patrons who give monthly on Patreon, including these individuals who have pledged especially charitable contributions:

Alden, Ben, Calvin, Christina, Daniel, David, Joshua, Joshua, Katy, Kevin, Laura, Robert, Robert, Thomas, Christopher

Ben, Bob, Brett, Charles, Charlie, Chelle, Darcy, Darren, David, Erik, Fred, Gail, Greg, Guillermo, Hunter, Jay, Jon, Malcolm, Mark, Nik, Nils, Sarah, Steven, Tal, Uri

Like the newsletter and want to help keep it going? Subscribe today on Patreon for access to private posts and other perks.