For subscribers only: A closer look at the partisan gap in consumer sentiment

There are separate inflections in partisanship after both Obama's and Trump's elections. Are we due for another?

By almost every measure, the US economy is in a better place now than it was a year ago. That’s true for job openings, the GDP, and wage growth — among other indicators. And in many ways, today’s environment for American workers is better than it was pre-pandemic. Primarily because of a shortage of workers, but also because of changing norms around contracts and bargaining, employees have more leverage over employers than they have seemed to have in a long while.

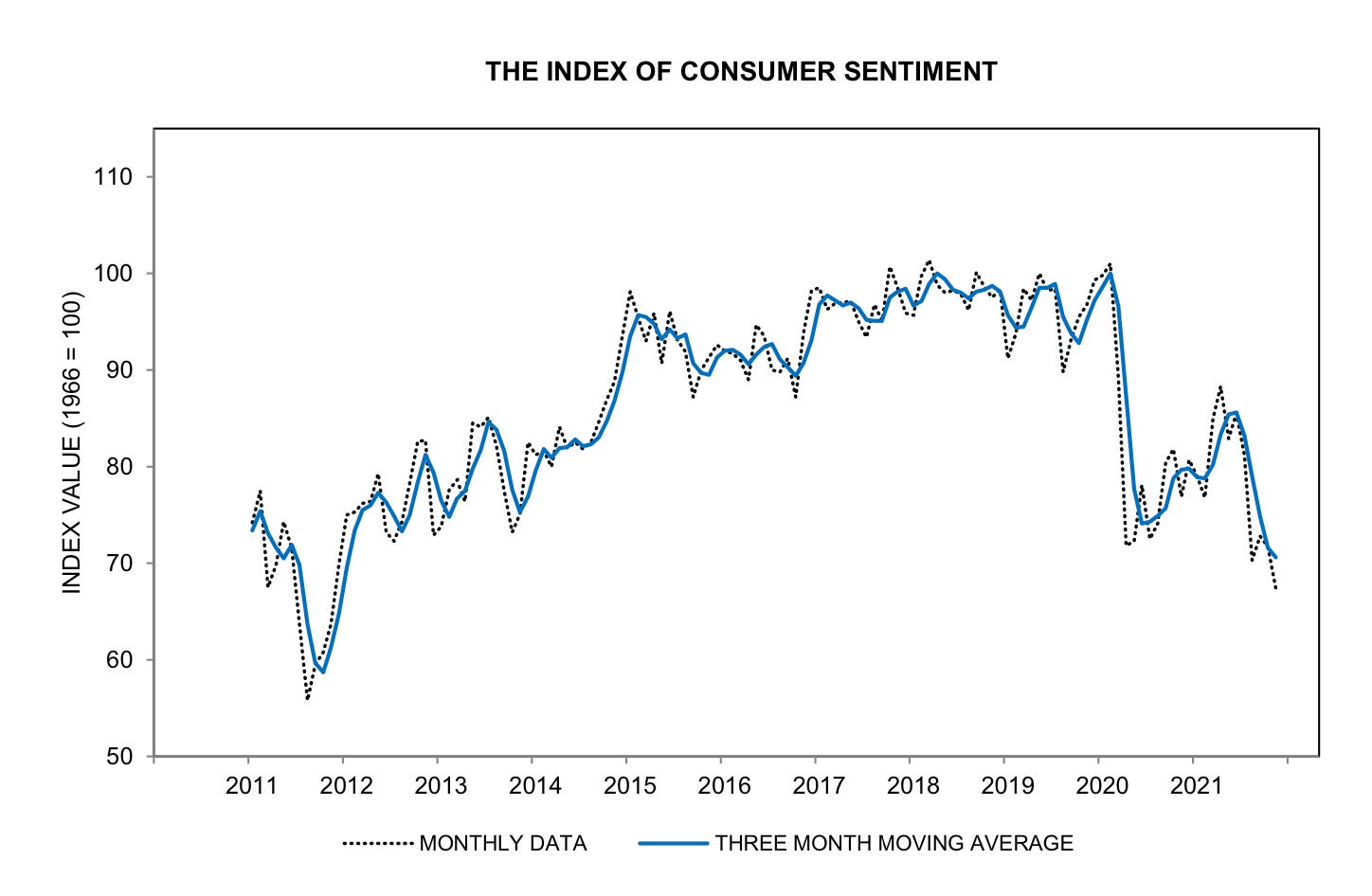

But most of this good news seems to be happening in the background. The foreground, in contrast, is much darker. The media’s relentless reporting on inflation and supply-chain issues leaves the impression that the value of the dollar is under threat, gas prices are draining Americans’ bank accounts and families can no longer find food to put on the table. As a result of this coverage, American’s confidence in the economy is lower now than it was during the throes of the lockdown stage of the covid-19 pandemic. Here is the trend according to the University of Michigan’s Index of Consumer Sentiment:

But there’s a problem with these data.

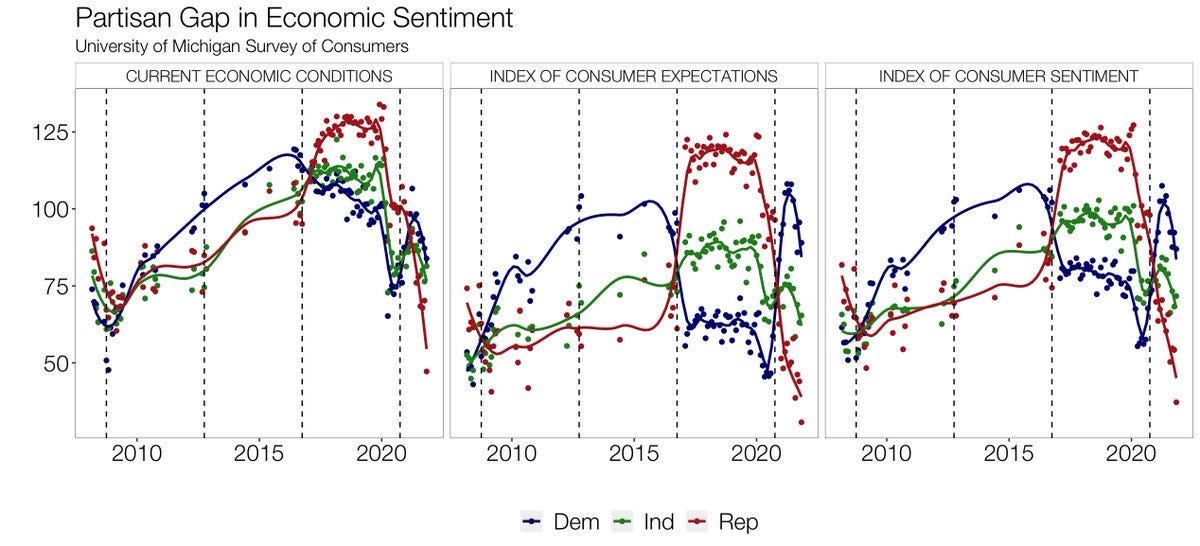

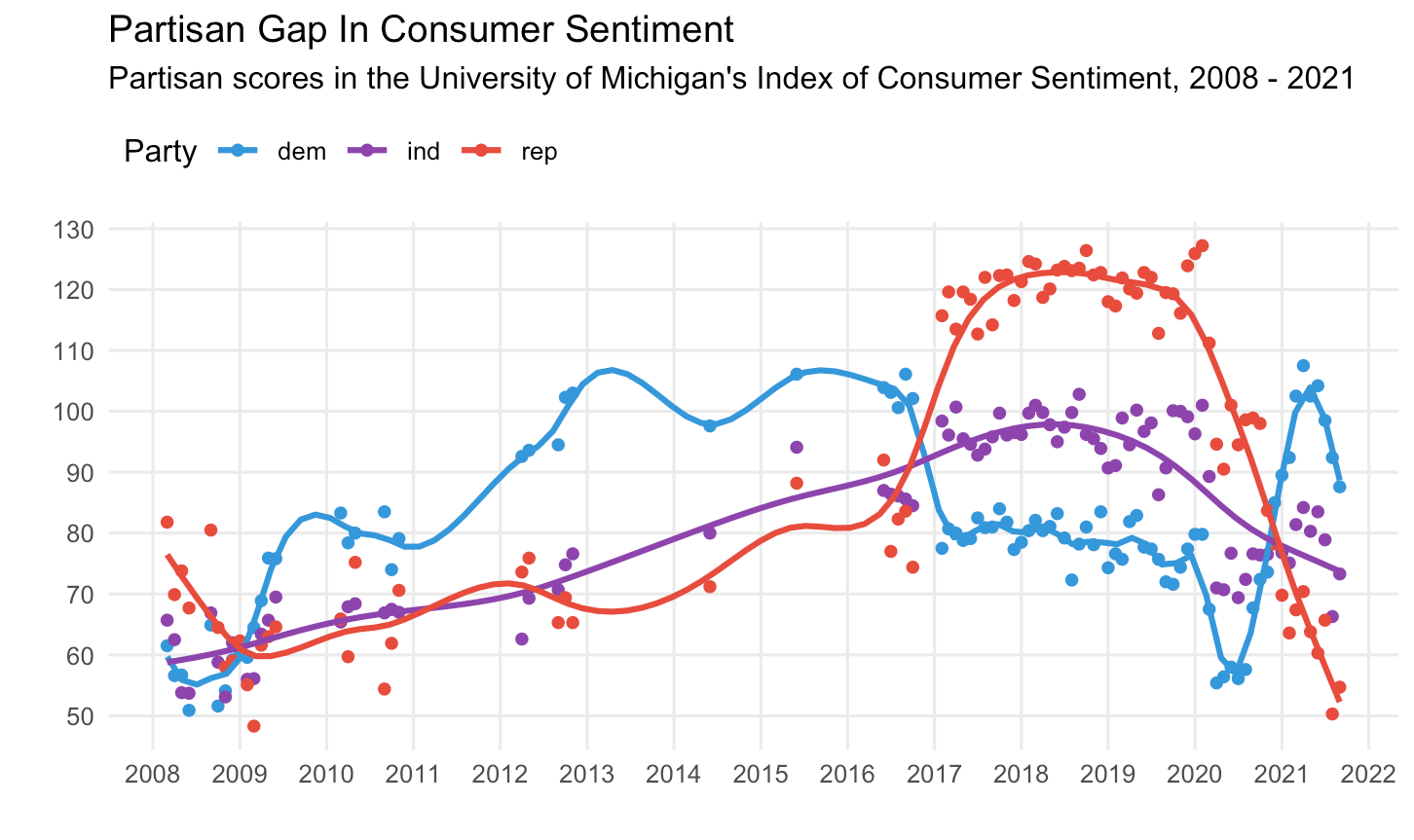

Friend of the blog Jonathan Robinson shared a chart online this week that showed trends in the Index of Consumer Sentiment (ICS), as well as the indices of current economic conditions (CEC) and consumer expectations (ICE) for the future, broken down by respondents’ partisan affiliations. The graph below shows the CEC, ICE, and ICS (in that order) for each partisan group:

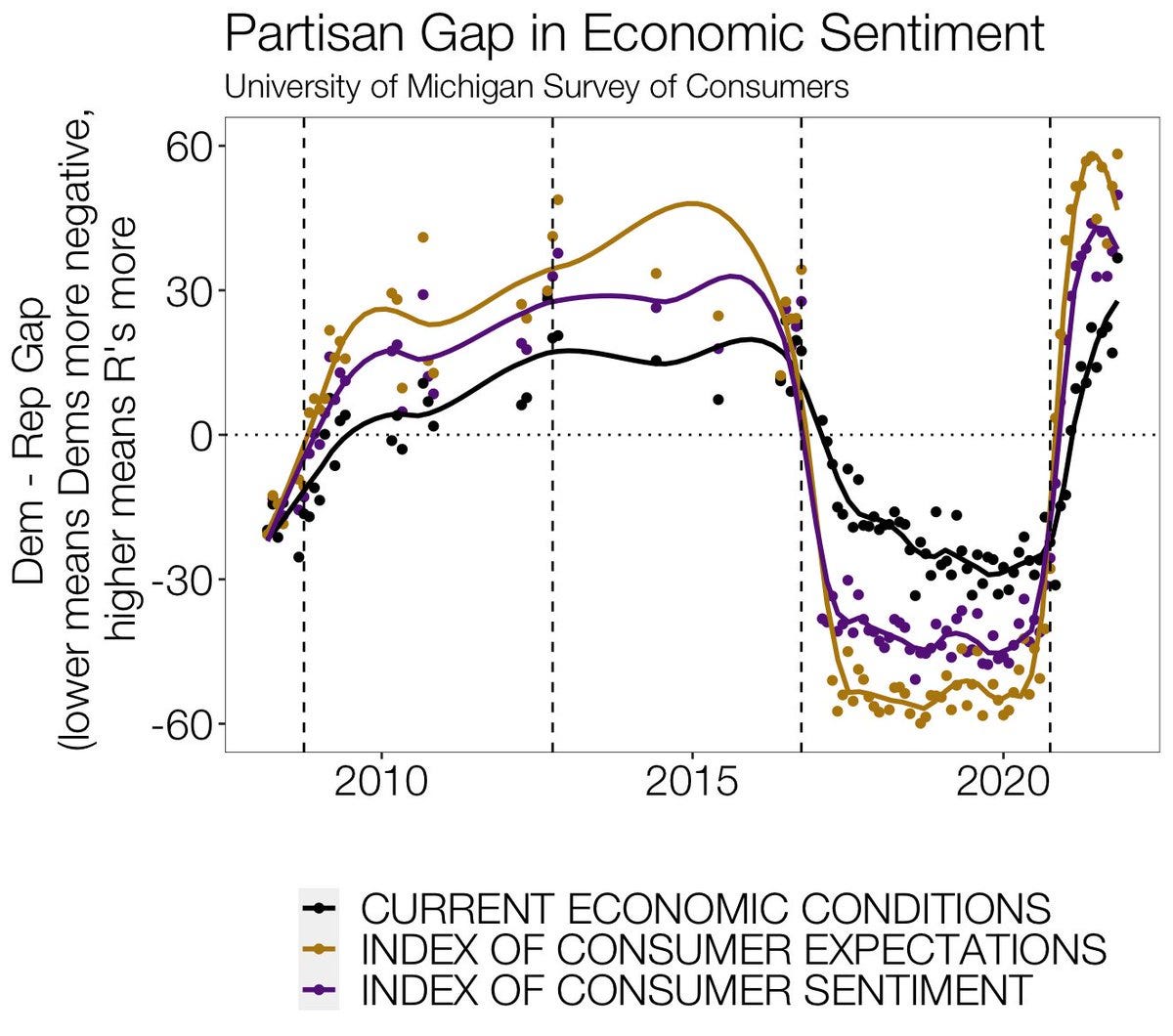

There are a few things worth noting, some surprising and some expected. The most obvious thing to note is the huge partisan gap in the ICS, which seemed to evolve slowly from 2009 to 2016 and then exploded when Donald Trump won the Electoral College and entered the White House in 2017. The chart below (also from Jon!) shows this gap, where higher lines indicate that Democrats are more optimistic about the economy than Republicans, and lines lower than zero indicate Republicans are more confident. Jon has put handy dashed vertical lines on the plot indicating the dates of the last four elections:

Notice how Democrats become more optimistic about the economy during the recovery under Barack Obama’s presidency, while Republican confidence holds roughly flat. And then there is a dramatic reversal of optimism once Donald Trump takes the presidency, driven simultaneously by decreasing satisfaction among Democrats and increasing satisfaction among Republicans. That being said, it is important to note that the reaction to Trump’s election on the right was much larger than on the left. Eg, whereas the ICS for Republicans jumps around 40 points, it sinks for Democrats by only around 20. This indicates that Republicans are processing actual economic indicators less rationally than Democrats are. Still, we don’t really know why; this could be due to the information they are exposed to, or differences in the psychology of a Democrat and Republican, or something else.

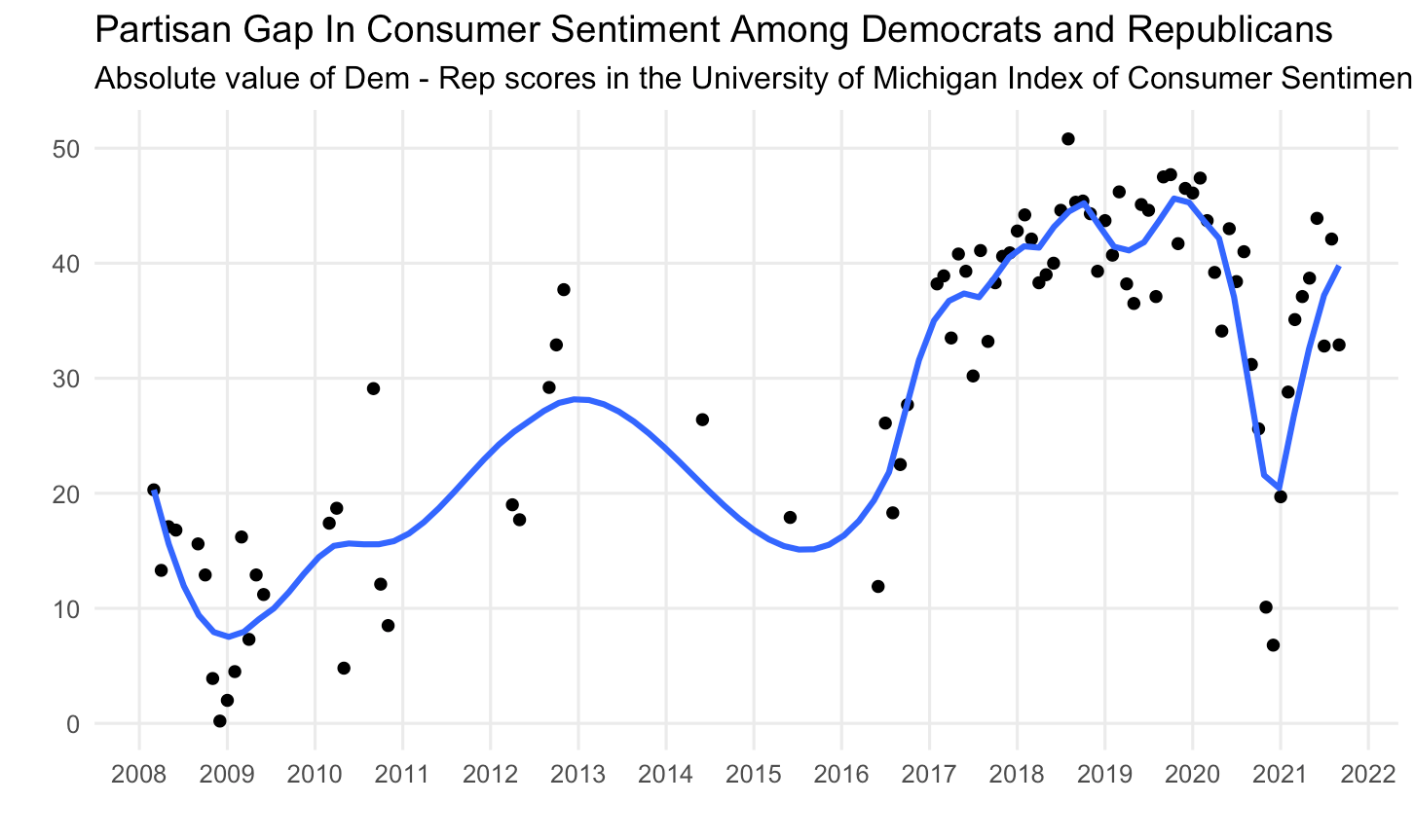

One thing I was curious about was how much of the current partisan gap in consumer sentiment came after Donald Trump was elected, versus after Barack Obama was. So I took the data from the University of Michigan and made the following plot, which shows the absolute value of the gap between Democratic and Republican scores on the ICS from the beginning of 2008 to today. You can see that the gap between the parties widened from around 10 to ~20 points from 2009 to 2016, and then from 20 to 40-45 points between 2017 and the end of 2019.

One thing to note is that polarization was “low” in late 2020/early 2021 because the Republican and Democratic scores on the ICS were crossing each other, as Democrats responded positively to both to improving conditions and Joe Biden’s election, whereas confidence among Republicans continued to sink after he won the Electoral College in November.

And that brings us to the present, in which Republicans have their worst-ever scores on the University of Michigan ICS — yes, worse than during the Great Recession — and Democrats are falling from a mid-2021 high. Confidence among political independents, as expected, is hovering between the scores for Democrats and Republicans (and trending lower).

And this brings me back to the original question.

What, exactly, is the aggregate Index of Consumer Sentiment telling us? Before our current degree of hyper-partisan polarization and identity politics, the index was likely a pretty good measure of the rationalization of (a) economic data, (b) the news, and (c) their own priorities. But it is now picking up a certain level of ideological and partisan bias as well.

Here’s another way to ask this: If we didn’t have high factionalization, would the Index of Consumer Sentiment be higher? I’m relatively sure it would. And that tells us a lot about how much we can trust it to provide an accurate reading of true economic sentiment in America. That isn’t to say we don’t use the measure, or that we don’t trust that it provides something useful for us — but we ought to acknowledge how polarization and radicalization have changed just how useful it is.

A final thought: The usual academic rationalizations about the power of aggregation stipulates that errors in information processing will cancel each other out at the extremes — that Democratic biases and Republican biases are equally as severe. But looking at this chart, I’m not sure that’s true! So what is the real ICS today? And if there are pervasive biases in this measure — if the power of right-wing media over Republican attitudes is asymmetric compared to the influence of left-wing media over Democrats — are there extreme biases in others? How bad is the problem? Does this threaten the wisdom of the aggregation of our votes as well?

I think we can reasonably speculate about the direction of the answer to that question. But I’ll have more to say on it later.

Happy holiday weekend to you all.

Hi Elliott,

The right-wing media likely plays a significant role in Republicans' attitudes. 770,000 Americans died from Covid and some are talking like the U.S. is in economic doomsday, rather than in a pandemic. Polarization and partisanship are making it very hard to collect good data. Maybe it's hard to gather good data overall, not just in election polls?

I hope you are having a safe holiday and had a good and safe Thanksgiving!

-Elliot

Having worked in the energy industry, one thing I find odd about ~the discourse~ surrounding gas prices is that high gas prices are really good for oil/gas companies since it allows them to finance big projects (I’d guess that’s at least part of the reason why leasing is actually up under Biden). When I was in industry, we would have loved to have WTI trading above $70/bbl, and it’s a bit odd to see people I know in energy simultaneously complain and cheer on high gas prices…

On a totally separate note - here’s a really good thread on polarization and how it doesn’t play evenly on the left and right. May be part of why republicans have a significantly larger swing in sentiment.

Happy thanksgiving!